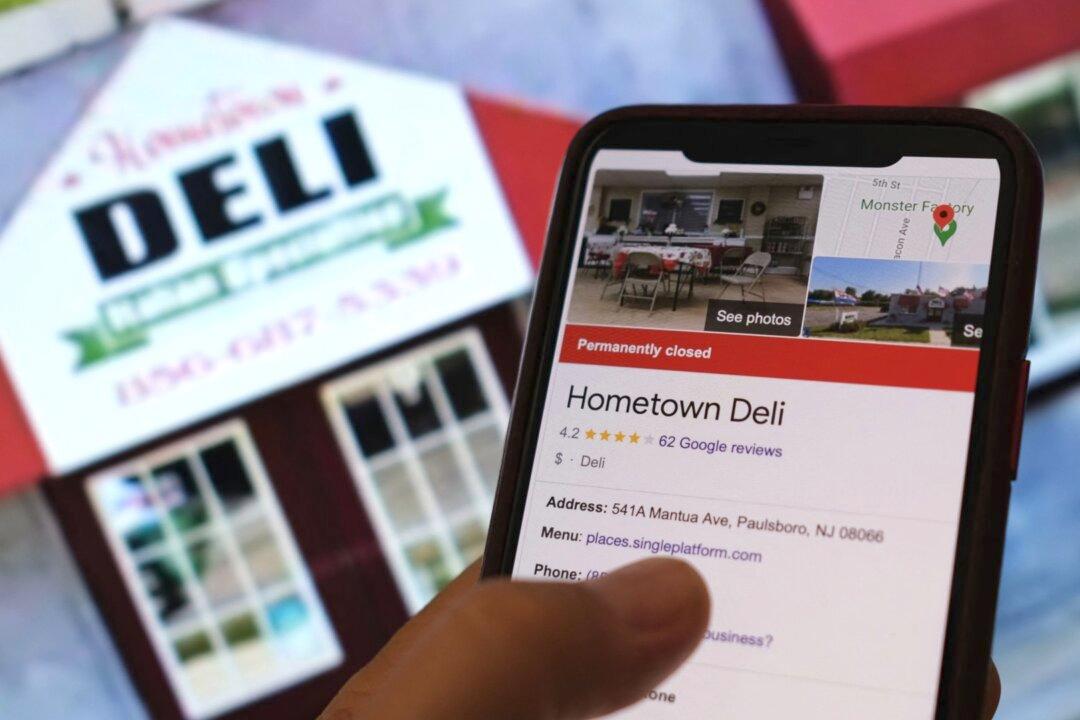

U.S. authorities on Monday filed civil and criminal charges against three men for allegedly orchestrating a large-scale market manipulation scheme that briefly pushed the valuation of a New Jersey deli to more than $100 million.

Prosecutors charged the men—Peter Coker Sr., 80, Peter Coker Jr., 53, both of North Carolina, and James Patten, 63, of Hong Kong—with 12 counts, including conspiracy to commit securities fraud, securities fraud, and conspiracy to manipulate securities prices. Patten was also charged with wire fraud, money laundering, and securities manipulation.