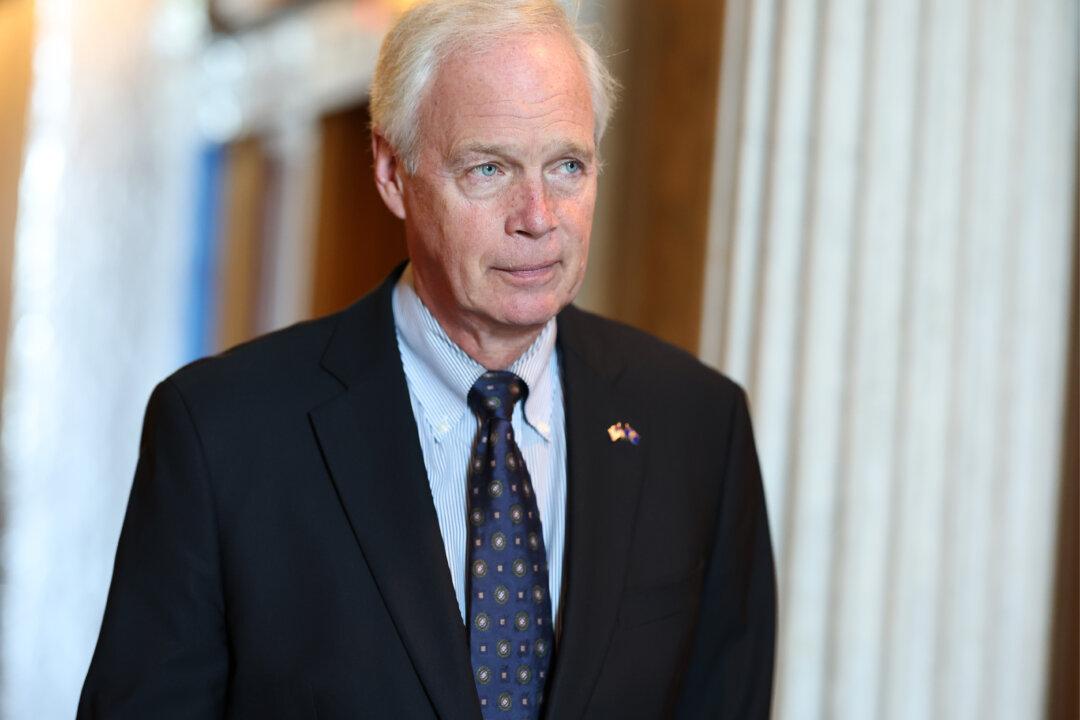

Sen. Ron Johnson (R-Wis.) illustrated in a statement on Sept. 20 how soaring inflation has eroded Americans’ purchasing power, pointing out in stark terms that $1 at the start of the Biden administration is now effectively worth just 88.3 cents.

Johnson, who’s been a repeated vocal critic of President Joe Biden’s handling of the economy and Democrats’ big spending bills, took to Twitter on Sept. 20 to criticize the impact of red-hot inflation on American households.