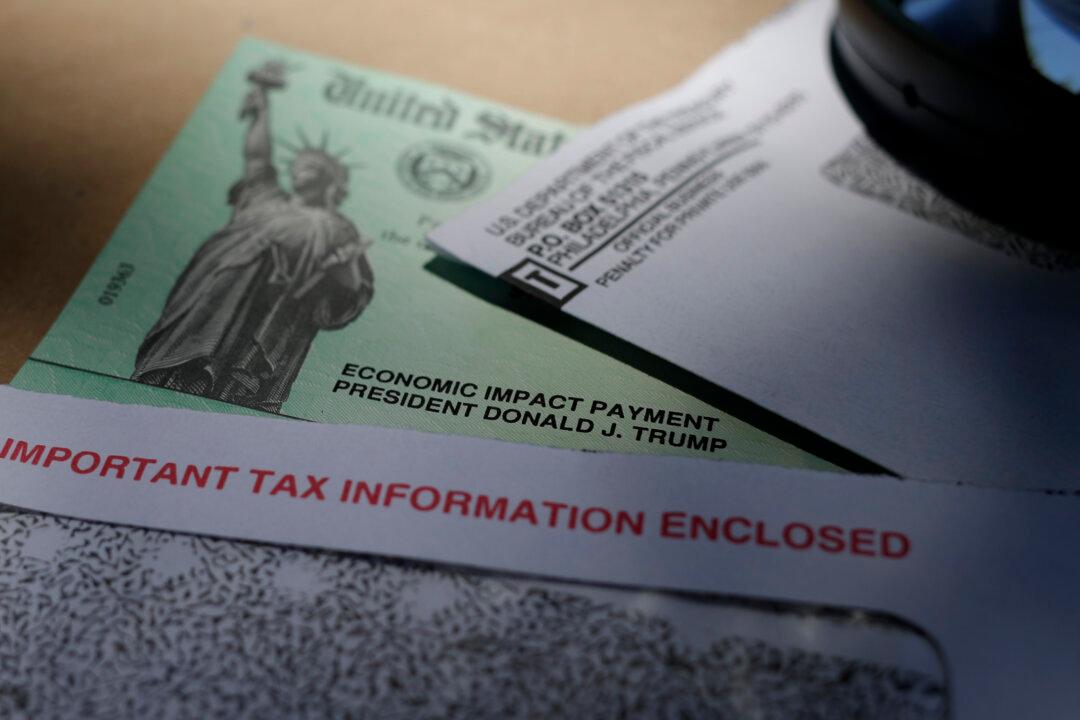

An audit of the Internal Revenue Service (IRS) shows that the agency did not send stimulus payments and checks to some living people, claiming they had already died.

During the pandemic, according to the Treasury’s inspector general office, when taxpayers attempted to get stimulus checks, they were told their accounts were locked because the IRS believed they were dead. The inspector general’s office also said that tens of thousands of accounts were deadlocked, meaning that taxpayers didn’t get their stimulus payments but were also blocked from filing tax returns or getting refunds back.