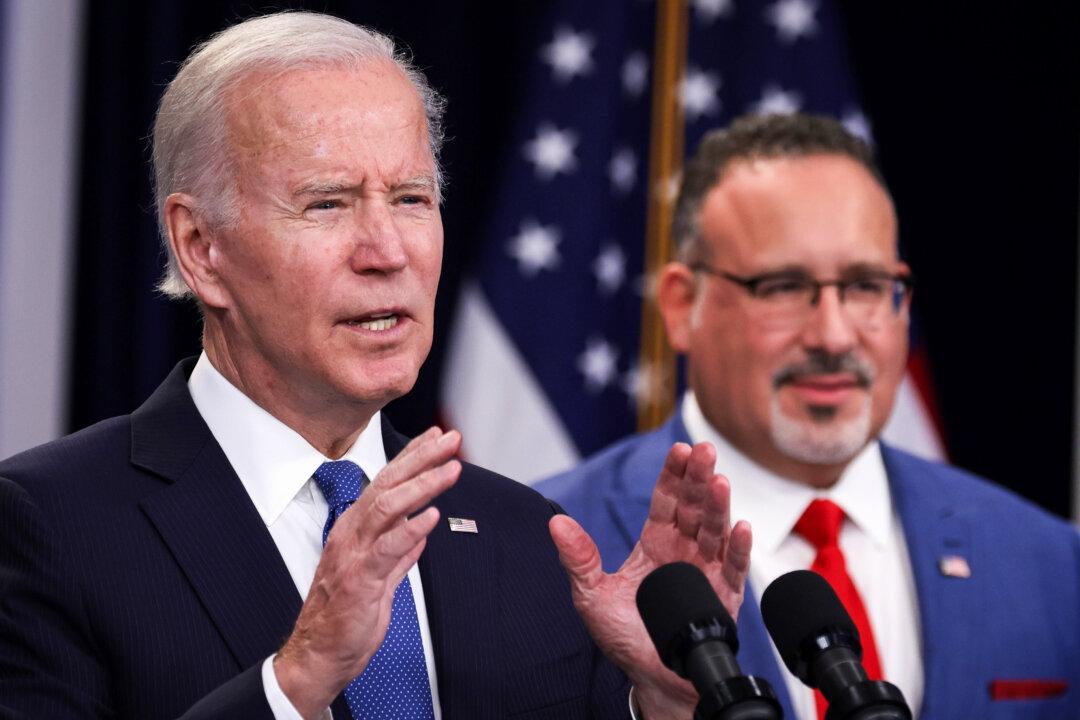

A total of $1.2 billion in federal student loan debt will be automatically discharged for 153,000 borrowers enrolled in President Joe Biden’s “most generous ever” repayment plan, the Department of Education stated on Feb. 21.

To be eligible for the latest round of student loan debt cancellation, the borrowers must be enrolled in the new income-driven repayment (IDR) plan, dubbed SAVE; have been making repayments for at least 10 years; and have originally taken out $12,000 or less for college.